Masa Depan Keamanan Digital: Teknologi Biometrik Palm Vein

Di era digital saat ini, keamanan data dan identitas menjadi prioritas utama. Password bisa lupa, kartu bisa hilang, sidik jari bisa dipalsukan, bahkan wajah pun masih bisa tertukar. Maka hadir sebuah terobosan baru yang lebih aman, praktis, dan canggih: Palm Vein Biometrics – teknologi pengenalan identitas melalui pola unik pembuluh darah di telapak tangan.

Apa itu Palm Vein Biometrics?

Palm Vein Biometrics adalah teknologi identifikasi berbasis pola pembuluh darah yang ada di telapak tangan. Setiap orang memiliki pola pembuluh darah yang unik, bahkan berbeda pada kembar identik sekalipun. Dengan hanya melambaikan tangan di atas scanner, sistem dapat mengenali identitas Anda dengan akurasi sangat tinggi.

Teknologi ini digunakan oleh Alaqan Ecosystem, yang berfokus pada sistem keamanan generasi berikutnya (Next Gen Biometrics). Cara kerjanya sederhana:

- Anda cukup melayangkan telapak tangan di atas pemindai.

- Sistem memetakan pola pembuluh darah.

- Data terenkripsi lalu dibandingkan dengan database pengguna.

- Jika cocok, identitas Anda langsung terkonfirmasi dalam hitungan detik.

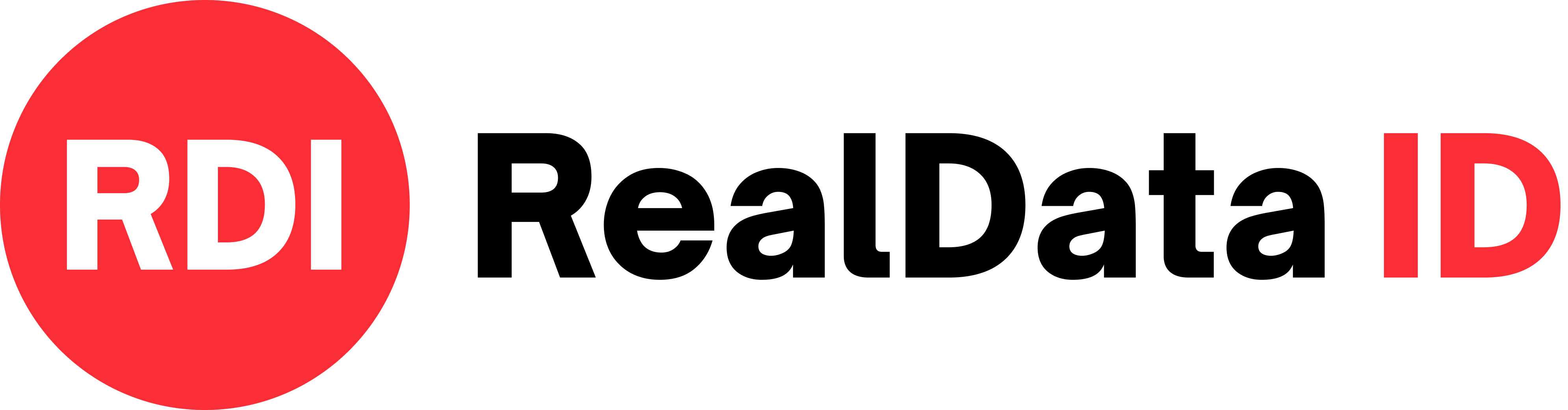

Mengapa Palm Vein Lebih Unggul?

Jika dibandingkan dengan metode autentikasi lain, Palm Vein memiliki banyak kelebihan:

- ✅ Selalu bersama Anda – tidak bisa hilang seperti kartu.

- ✅ Tidak bisa dipalsukan – pola pembuluh darah ada di dalam tubuh, bukan di permukaan.

- ✅ Cepat & akurat – proses verifikasi hanya butuh sekitar 2 detik.

- ✅ Privasi terjaga – berbeda dengan wajah dan sidik jari yang bisa direkam diam-diam.

- ✅ Non-higienis? Tidak lagi! – cukup melayangkan tangan tanpa menyentuh perangkat.

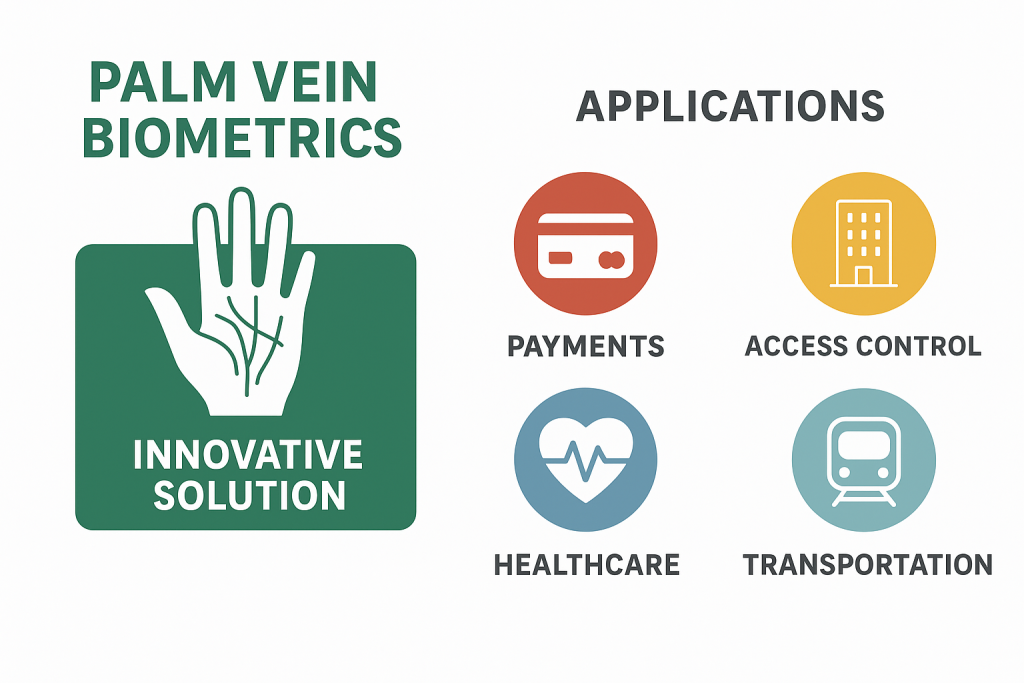

Use-Case Nyata Palm Vein Biometrics

- Sistem Pembayaran Super Cepat

Bayangkan saat Anda berbelanja di supermarket. Tidak perlu lagi mengeluarkan kartu, mengetik PIN, atau membuka aplikasi di smartphone. Cukup dengan melambaikan tangan di atas mesin kasir, transaksi langsung berhasil.

➝ Hemat waktu, aman, dan praktis. - Perbankan dan ATM

Bank dapat meningkatkan jumlah transaksi digital dengan metode pembayaran yang lebih aman. Risiko pencurian data kartu dan PIN berkurang drastis.

➝ Nasabah merasa lebih nyaman dan percaya. - Akses Gedung dan Keamanan Kantor

Tidak perlu kartu ID atau kunci elektronik. Palm Vein bisa digunakan untuk membuka pintu kantor, laboratorium, atau ruang server dengan keamanan tingkat tinggi.

➝ Cocok untuk perusahaan, universitas, hingga instansi pemerintahan. - Layanan Kesehatan

Rumah sakit dapat mengidentifikasi pasien dengan cepat tanpa perlu KTP atau kartu BPJS. Data medis bisa langsung muncul hanya dengan verifikasi telapak tangan.

➝ Sangat berguna dalam keadaan darurat. - Transportasi Publik & Event

Bayangkan masuk ke stasiun kereta, bandara, atau konser musik tanpa tiket fisik. Palm Vein bisa menjadi tiket digital yang anti-palsu.

➝ Efisiensi tinggi sekaligus meningkatkan pengalaman pengguna.

PT REAL DATA ID & Alaqan: Membawa Solusi Masa Depan ke Indonesia

Sebagai perusahaan teknologi, PT REAL DATA ID berkomitmen menghadirkan inovasi yang memudahkan kehidupan sehari-hari sekaligus menjaga keamanan data. Melalui kolaborasi dengan Alaqan, kami siap memperkenalkan dan mengimplementasikan Palm Vein Biometrics di berbagai sektor di Indonesia.

Dengan teknologi ini, kita tidak hanya berbicara tentang keamanan, tetapi juga kenyamanan, efisiensi, dan masa depan digital yang lebih manusiawi.

Penutup

Password bisa dicuri, kartu bisa hilang, wajah bisa tertutup masker. Tetapi pembuluh darah di telapak tangan Anda adalah identitas yang unik, aman, dan tidak tergantikan.

Saatnya beralih ke Palm Vein Biometrics – karena masa depan keamanan ada di dalam genggaman tangan Anda.

👉 Tertarik mengimplementasikan teknologi ini di bisnis atau institusi Anda?

Hubungi PT REAL DATA ID dan mari wujudkan keamanan digital yang lebih cerdas dan terpercaya.